Why Is GoPro Struggling?

I used to swing trade GoPro a couple of months ago while they were undergoing a lawsuit, and their Karma drone was recalled. I haven’t seen many changes in the company other than new accessories for their products.

The company continues to get bashed by popular banks, hedge fund managers, and analysts. If the company doesn’t improvise and innovate, they won’t see their stock increase and consolidate in double digits.

The good thing about this stock is that it makes a great profitable swing trade and short term investment for anyone with smaller brokerage accounts.

Balls On Wall Street Trading Plan

4-Hour Chart

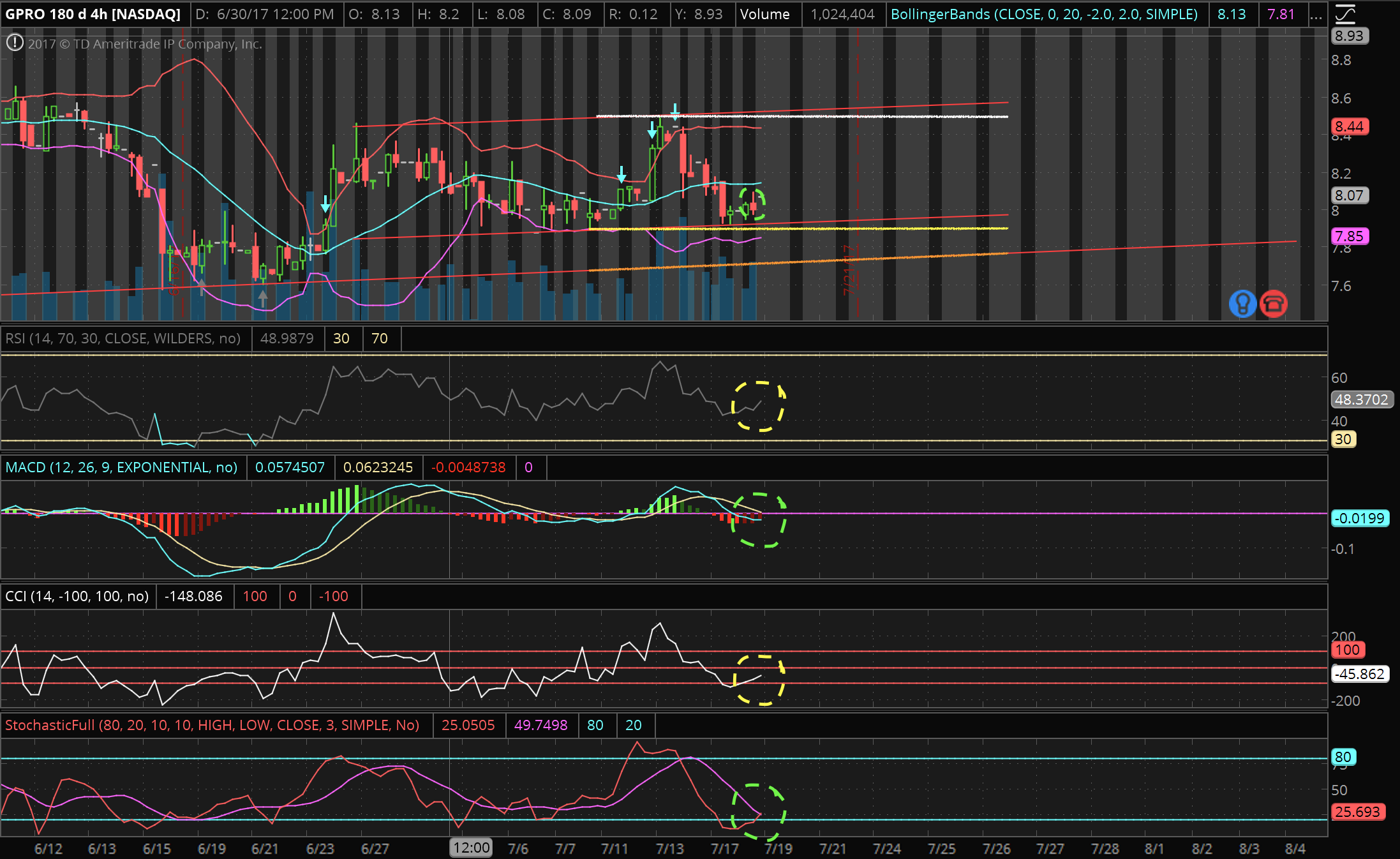

These are the momentum oscillators and indicators I use to trade all stocks.

- The two red lines in an uptrend represent a channel.

- The white line is the current resistance level of $8.49.

- The yellow line is the support level at $7.90.

- The orange line is the is an uptrend connected to the previous low of $7.15.

- The circles imply good-dangerous price entry points. green (good), yellow (decent), orange (caution) and red (danger).

As you can see the stock has been following the uptrend channel accordingly. The last candle stick formed an inverted red cross. This implies that the next candle stick may be higher in price, which is why the after hours price was higher. The yellow circle in the Relative Strength Index (RSI) is in yellow because the line increased too quick for such a small price fluctuation. The same idea applies to the yellow circle in the Commodity Channel Index (CCI).

The yellow circle in the Relative Strength Index (RSI) is in yellow because the line increased too quick for such a small price fluctuation. The same idea applies to the yellow circle in the Commodity Channel Index (CCI).

I can see the stock going a bit lower, but overall I believe $7.90-$8.00 to be a good entry point for a short term trade. If the price goes down below $7.90 expect for it to fall lower into the $7.70-$7.80 price range. My sell point would be $8.30-$8.40.

I do not hold this stock for more than 3 days depending on indicators.

If the price goes down below $7.90 expect for it to fall lower into the $7.70-$7.80 price range.

This post is my personal reference based on my own analysis and research. Always remember to pay attention to the news along with your own research. Trade at your own risk.

Thank you for reading!